Dear candidate

we are providing tentative solution.

Most of the current affairs were from our test series . we will come out with details.

Direct CURRENT AFFAIRS question from our test series.WE WILL PUT THE DOCUMENT IN SUPPORT

1.un-redd plus

2.agenda21

3 district mineral fund

4 NDB

5KASTURIRANGAN REPORT

6 SOVERIGN GOLD BOND SCHEME

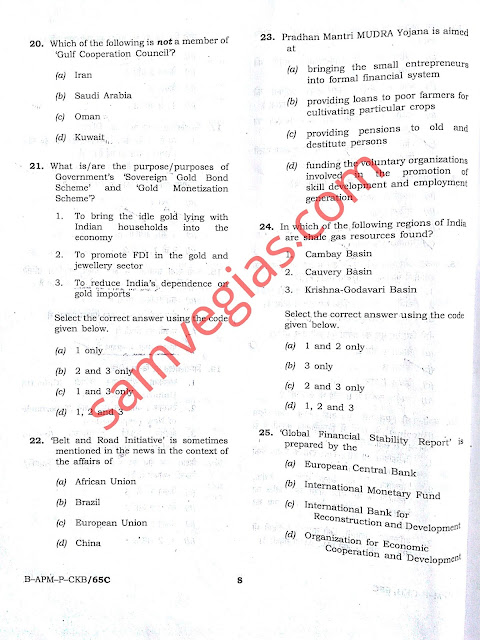

7.BELT AND ROAD INITIATIVE

8MUDRA YOJANA

9 ATAL PENSION YOJANA

10 GLOBAL FINANCIAL REPORT

11 BEE

12ITER

13 ISA

14 AIR QUALITY INDEX

15ASTROSAT

16 MANGLAYAN

17 PARIS AGREEMENT

18 PAYMENTS BANK

19LIFI

20INDC

21UDAY

22 UN CCD

23PM FASAL BIMA YOJANA

25NGRBA

26 STAND UP INDIA

27 KYOTO PROTOCOL

28 MISSION INDRADHANUSH

29 GREEN INDIA MISSION

30EASE OF DOING BUSSINESS

31 TPP

32INDIA AFRICA SUMMIT

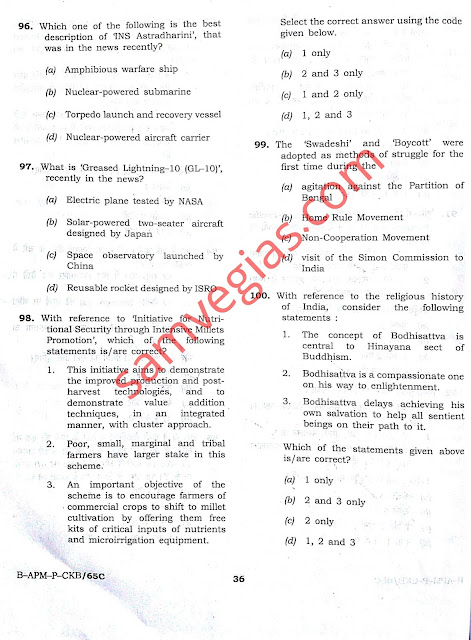

33ASTRADHARINI.

SUBJECT WISE DISTRIBUTION OF GS PAPER

5 QUESTION FROM POLITY+ 5 QUESTION FROM GEOGRAPHY+ 6 QUESTION OF MODERN HISTORY+12 QUESTION OF ENVIRONMENT AND ECOLOGY.

It serves as the foundation for nearly every GHG standard and program in the world - from the International Standards Organization to The Climate Registry - as well as hundreds of GHG inventories prepared by individual companies.

The GHG Protocol also offers developing countries an internationally accepted management tool to help their businesses to compete in the global marketplace and their governments to make informed decisions about climate change.

The imminent final approval for the NIMZ, which is expected to give a fillip to Prime Minister Narendra Modi's Make in India campaign, comes four years after the concept was mooted to boost manufacturing in the country and two years after the Department of Industrial Policy and Promotion gave an in-principle nod to Andhra Pradesh in this regard.

Q12---B

All courses would be offered free of cost under this programme however fees would be levied in case learner requires certificate.

we are providing tentative solution.

Most of the current affairs were from our test series . we will come out with details.

Direct CURRENT AFFAIRS question from our test series.WE WILL PUT THE DOCUMENT IN SUPPORT

1.un-redd plus

2.agenda21

3 district mineral fund

4 NDB

5KASTURIRANGAN REPORT

6 SOVERIGN GOLD BOND SCHEME

7.BELT AND ROAD INITIATIVE

8MUDRA YOJANA

9 ATAL PENSION YOJANA

10 GLOBAL FINANCIAL REPORT

11 BEE

12ITER

13 ISA

14 AIR QUALITY INDEX

15ASTROSAT

16 MANGLAYAN

17 PARIS AGREEMENT

18 PAYMENTS BANK

19LIFI

20INDC

21UDAY

22 UN CCD

23PM FASAL BIMA YOJANA

25NGRBA

26 STAND UP INDIA

27 KYOTO PROTOCOL

28 MISSION INDRADHANUSH

29 GREEN INDIA MISSION

30EASE OF DOING BUSSINESS

31 TPP

32INDIA AFRICA SUMMIT

33ASTRADHARINI.

SUBJECT WISE DISTRIBUTION OF GS PAPER

S no

|

Topic/subject

|

No of

questions

|

1

|

Indian polity

|

5

|

2

|

History (modern

,ancient,medieval)

|

16(6,9,1)

|

3

|

geography

|

5

|

4

|

Environment

and ecology and related CA

|

19

|

5

|

International

organisations and their functions*

|

15

(almost current affairs)

|

6

|

Indian economy

|

22 (almost

current affairs)

|

7

|

Govt policies

& programmes

|

6 (almost

current affairs)

|

8

|

Science and

technology

|

12(almost

current affairs)

|

5 QUESTION FROM POLITY+ 5 QUESTION FROM GEOGRAPHY+ 6 QUESTION OF MODERN HISTORY+12 QUESTION OF ENVIRONMENT AND ECOLOGY.

Q1 –B

Médecins Sans

Frontières (MSF) or Doctors Without Borders, is

an international humanitarian-aid non-governmental organization (NGO).

Q2-C

The Economics

of Ecosystems and Biodiversity (TEEB)

is a global initiative focused on “making nature’s values visible”.

Its principal objective is to mainstream the values of biodiversity and

ecosystem services into decision-making at all levels. It aims to achieve this

goal by following a structured approach to

valuation that helps decision-makers recognize the

wide range of benefits provided by ecosystems and biodiversity, demonstrate

their values in economic terms and, where appropriate, suggest how to capture

those values in decision-making.

IMF IS NOT THE PART

Q3 ---A

Q4 –D

Q5-A

The Greenhouse Gas Protocol (GHG Protocol) is the most widely used

international accounting tool for government and business leaders to

understand, quantify, and manage greenhouse gas emissions. A decade-long

partnership between the World Resources Institute (WRI) and the World Business

Council for Sustainable Development (WBCSD), the GHG Protocol is working with

businesses, governments, and environmental groups around the world to build a

new generation of credible and effective programs for tackling climate change.It serves as the foundation for nearly every GHG standard and program in the world - from the International Standards Organization to The Climate Registry - as well as hundreds of GHG inventories prepared by individual companies.

The GHG Protocol also offers developing countries an internationally accepted management tool to help their businesses to compete in the global marketplace and their governments to make informed decisions about climate change.

Q6- C

Q7----A

Agenda 21 is a non-binding,

voluntarily implemented action plan of the United Nations with regard to

sustainable development. It is a product of the Earth Summit (UN Conference on Environment

and Development) held in Rio de Janeiro, Brazil, in 1992.

Q8 –C

Q9-d

Viruses are known to infect almost any kind of host that has living cells. Animals, plants, fungi, and bacteria are all subject to viral infection

Q10—B

Base erosion and profit shifting (BEPS)

is a tax avoidance strategy used by multinational companies, wherein profits

are shifted from jurisdictions that have high taxes (such as the United States

and many Western European countries) to jurisdictions that have low (or no)

taxes (so-called tax havens)

Q11-A

Andhra

Pradesh is set to house India's first national investment and manufacturing

zone after the state assured the Centre of availability of 10 sq km of land in

one place in Prakasham district.The imminent final approval for the NIMZ, which is expected to give a fillip to Prime Minister Narendra Modi's Make in India campaign, comes four years after the concept was mooted to boost manufacturing in the country and two years after the Department of Industrial Policy and Promotion gave an in-principle nod to Andhra Pradesh in this regard.

Q12---B

Each District

Mineral Foundation is established by the State Governments by notification as a

trust or non-profit body in the mining operation affected districts. Objectives

The objective of District Mineral Foundation is to work for the interest of the

benefit of the persons and areas affected mining related operations in such

manner as may be prescribed by the State Government.

Q13—D

SWAYAM or Study Webs of Active –Learning for Young Aspiring Minds

programme of Ministry of Human

Resource Development, Government of India, Professors of centrally

funded institutions like IITs, IIMs, central universities will

offer online courses to citizens of India.[1]All courses would be offered free of cost under this programme however fees would be levied in case learner requires certificate.

Q14—D

Q15-B

Q16-B

17-B

18-D

19-D

20-A

21-C

22-D

23-A

24-D

Ministry of

Petroleum and Natural Gas (MoPNG) has identified

six basins as

potentially shale gas bearing. These are Cambay,

Assam-Arakan,

Gondwana, Krishna-Godavari, Kaveri, and the

Indo-Gangetic

plain

25-B

26-C

27-B

Regional Comprehensive Economic Partnership (RCEP)

is a proposed free trade agreement (FTA) between the ten member states of the

Association of Southeast Asian Nations (ASEAN)

28-D

29-D

30-C

31-A.

121 countries from across the globe are part of the alliance and more

are being asked to join it.

32-B

33-C

34-C

35-D

36-B

The proposed AQI will consider eight pollutants (PM10, PM2.5,

NO2, SO2, CO, O3, NH3, and Pb) for

which short-term (up to 24-hourly averaging period) National Ambient Air

Quality Standards are prescribed.

37-D

ASTROSAT with a lift-off mass of about 1513 kg was launched into a

650 km orbit inclined at an angle of 6 deg to the equator by PSLV-C30.

Only the United States, European Space Agency, Japan and Russia have

such observatories in space.

38-C

39-

40-D http://www.thehindu.com/news/national/other-states/maharashtra-gets-state-butterfly/article7342955.ece

41-C

The Mars Orbiter Mission (MOM), also called is a space

probe orbiting Mars

since 24 September 2014. It was launched on 5 November 2013 by the Indian Space Research Organisation

(ISRO).[11][12][13][14]

It is India's

first interplanetary mission[15]

and ISRO has become the fourth space agency to reach Mars, after the Soviet space program, NASA, and the European Space Agency.[16][17]

It is the first Asian nation to reach Mars orbit, and the first nation in the

world to do so in its first attempt.

42-B

43-D

44-C

45-D

46-d

47-b

48-C

49-A

50—B

51-B

52-C

The GHI combines 4 component indicators: 1) the

proportion of the undernourished as a percentage of the population; 2) the

proportion of children under the age of five suffering from wasting; 3) the

proportion of children under the age of five suffering from stunting; 4)

the mortality rate of children under the age of ..

53-C

54-d

Acceptance of demand deposits. Payments bank will

initially be restricted to holding a maximum balance of Rs. 100,000 per

individual customer. Issuance of ATM/debit cards. Payments banks,

however, cannot issue credit cards.

55-C

56-B

57-D

57-C

58-C

59-C

60-B

61-A

62-D

63-D

64-D

65-C

66-C

67-C

68-D

It measures the number of months of money

available in the national bank to cover the cost of imports.

69-C

70-B

71-C

72-D

73-A,PM

CHAIRS THE MEETING

74-B

75-C

76-C

77-B

78-D

79-A

80-C

81-B

82-A

83-C

84-C

85-B

86-A

87-C

88-d

89-B

90-B

91-D ONLY

12 NATION,TRADE

92-A

93-C

94-D

95-*

96-C

97-A

98-C

99-A

100-B